Response from Thai888 Law to questions on what is done by the law, without prejudice

Dear —–,

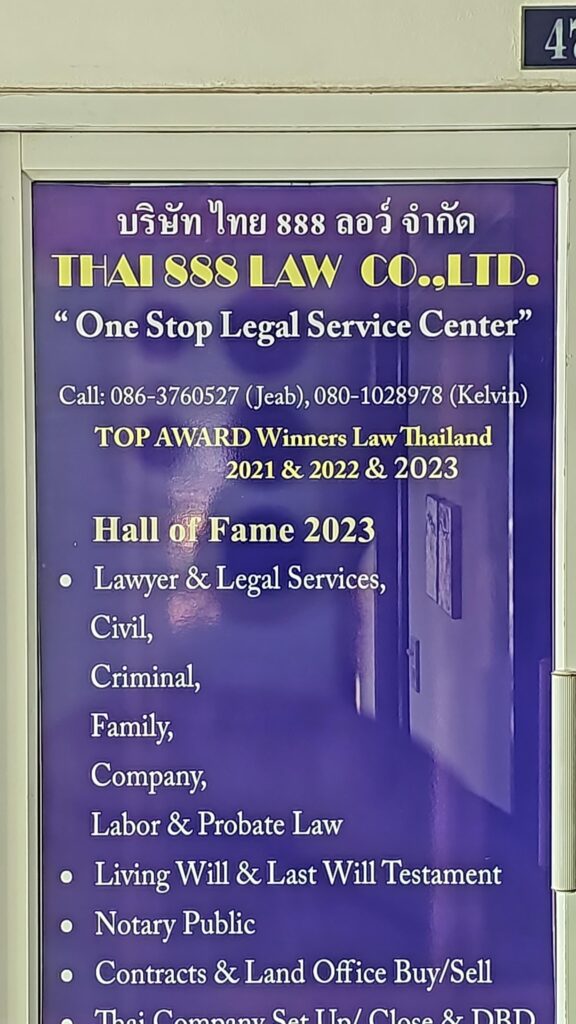

Thank you for reaching out to Thai888 Law Company Pattaya Ltd. We are a leading firm specializing in wills, probate, estate administration, and inheritance matters in Thailand, with extensive experience assisting international clients, including expats and their families. As award-winning experts in Wills & Probate Law Firm of the Year (2024 and 2025), we handle complex cases involving foreign assets, executors, and cross-border distributions. Our team, including certified lawyers, notaries, and accountants, ensures compliance with the Civil and Commercial Code of Thailand (CCC), particularly Sections 1599–1785 on succession and inheritance.

Based on your query, we understand you are seeking detailed information on the role of executors (known as “estate administrators” or “managers of the estate” under Thai law) in handling a deceased person’s assets in Thailand. This includes their responsibilities, typical timeframes, associated costs, processes for selling assets, and repatriation of sale proceeds (e.g., to beneficiaries abroad). We will outline this below based on Thai inheritance law. Please note that specifics can vary by case (e.g., whether there is a will, the nature of assets, or disputes among heirs). We recommend a consultation to review your situation—contact us at [email protected] or +66 80 102 8978 to schedule one.

For clarity, we have structured the information using tables where appropriate to compare key elements.

1. List of Work Done by Executors (Estate Administrators)

Under Thai law (CCC Sections 1711–1727), an executor is appointed by the court (via a probate order or “Grant of Administration”) to manage and distribute the deceased’s estate. This applies whether there is a valid will (testate succession) or not (intestate succession under CCC Section 1629, where assets go to statutory heirs in six classes: descendants, parents, siblings, etc., plus the surviving spouse). The executor acts as a fiduciary, ensuring fair distribution while protecting creditors’ rights.

Executors must be of legal age (18+), mentally competent, and not bankrupt. Foreign executors (e.g., heirs abroad) must typically appear in Thai court at least twice (to sign documents and testify), though a power of attorney (POA) can be granted to a Thai lawyer like us for subsequent steps. If no executor is named in a will, the court appoints one (often a statutory heir or lawyer) with heirs’ consent.

Key responsibilities include:

| Category | Specific Tasks |

|---|---|

| Initial Administration | – File a petition for probate in the Provincial Court where the deceased resided or assets are located (requires death certificate, will if any, family tree, asset list, and heir consents). – Appear in court for hearings (1–2 times for foreigners). – Obtain the court’s “Grant of Administration” (probate order) and “No Appeal Certificate” (after 30 days, confirming finality). – Inventory all assets (e.g., bank accounts, condos, vehicles, shares) and liabilities within 1 month of appointment (CCC Section 1720). |

| Debt and Tax Settlement | – Notify creditors and pay all debts, funeral expenses, and taxes from estate funds (CCC Section 1735; debts must be settled before distribution). – File inheritance-related taxes (no direct inheritance tax in Thailand, but income tax on gains from sales; 5% withholding on property transfers; estate tax clearance if applicable under Revenue Code). |

| Asset Management and Distribution | – Secure and value assets (e.g., appraise property via Land Office). – Distribute assets to beneficiaries/heirs per the will or intestate rules (e.g., 50% to spouse + equal shares to children under CCC Section 1633). – Handle guardianship for minor heirs (controller of property until age 20+1 day). – Close accounts (e.g., banks require probate order) and transfer titles (e.g., condos via Land Office). |

| Reporting and Closure | – Provide regular updates to heirs. – Defend the estate in court if disputes arise (e.g., heir contests). – Finalize distribution and resign from role with court approval (CCC Section 1727). |

If disputes occur (e.g., heir disagreements), the process may involve litigation, extending timelines. At Thai888 Law, we often act as co-executor or under POA to handle these tasks, especially for overseas clients, coordinating with embassies and foreign courts.

2. Timeframe

The probate and administration process in Thailand is court-supervised and can vary based on complexity (e.g., simple bank accounts vs. disputed property). Foreign elements (e.g., translated documents from abroad) add time. Typical timelines assume no disputes and proper documentation.

| Phase | Estimated Timeframe | Notes |

|---|---|---|

| Document Preparation and Filing | 2–4 weeks | Gather/translate documents (death certificate, will, family proofs; must be legalized by Thai embassy abroad and Ministry of Foreign Affairs in Thailand). File petition in court. |

| Court Hearings and Probate Order | 45–90 days | Court sets hearing date (2–3 months after filing). Executor testifies under oath. Order issued if no objections (30-day appeal window). |

| Asset Inventory and Debt Settlement | 1–3 months | Identify/pay debts; banks/Land Office process transfers (e.g., 1–2 weeks for bank closure). |

| Distribution and Closure | 1–6 months | Transfer assets; obtain clearances. Total from death to full closure: 3–12 months (simple cases) or 1+ years (complex/disputed). |

| Overall Process | 4–12 months | Faster if foreign probate order is recognized (avoids full Thai probate); slower for foreigners requiring multiple Thailand visits. |

In our experience, uncontested cases with a clear will take 4–6 months. Delays often stem from incomplete foreign documents or heir disputes.

3. Costs

There is no inheritance tax in Thailand (abolished in 2015), but other fees apply. Costs are nominal for court filings but rise with asset value, lawyer involvement, and sales. Executors are entitled to reasonable compensation from the estate (court-approved, often 1–5% of estate value under CCC Section 1739). As a firm, we charge fixed or hourly fees based on the case.

| Cost Type | Estimated Amount (THB) | Details |

|---|---|---|

| Court Fees | 200–1,000 | Filing probate petition; minimal and fixed. Additional for hearings or appeals. |

| Legal Fees (Thai888 Law) | 50,000–200,000+ | Drafting will: 10,000–20,000; full probate/administration: based on estate size (e.g., 100,000 for simple case). Hourly: 5,000–10,000. We handle translations, court appearances, and POAs. |

| Translation/Legalization | 5,000–20,000 per document | Foreign docs (e.g., death certificate) translated/certified; apostille/MOFA legalization. |

| Taxes and Transfers | Varies (2–7% of asset value) | Property sales: 2% transfer fee + 3.3% specific business tax (if <5 years ownership); 1% withholding tax; income tax on gains (up to 20% progressive). No direct inheritance tax. |

| Executor Compensation | 1–5% of estate | Paid from estate; court-approved. For sales, agent fees (2–3%). |

| Other (Appraisals, Travel) | 10,000–50,000 | Asset valuations; foreign executor travel/court appearances. Total for simple estate: 100,000–300,000 THB. |

Costs are deducted from the estate before distribution. We provide transparent quotes after reviewing your case—no upfront fees without consultation.

4. Selling Assets

Executors have authority to sell assets post-probate to settle debts or distribute proceeds (CCC Section 1721). This requires court order approval for high-value items (e.g., real estate). Process:

- Inventory and Valuation: Executor lists assets (e.g., condos, vehicles, shares) and obtains appraisals (Land Department for property).

- Court Approval: Petition court for sale permission if needed (e.g., for immovable assets like land/condos; 1–2 months).

- Sale Execution:

- Movable assets (e.g., cars, bank funds): Transfer via Department of Land Transport or banks with probate order (1–2 weeks).

- Immovable assets (e.g., condos): Sell via real estate agent; transfer title at Land Office (requires buyer consent, taxes paid). Foreigners inheriting condos must comply with Condominium Act (foreign quota ≤49%; dispose within 1 year if non-compliant).

- Land: Foreigners need Interior Ministry approval (rare; often sold to Thai buyers).

- Proceeds Handling: Deposit sales funds in estate account; deduct taxes/fees; distribute remainder to heirs.

- Restrictions: Sales must be in good faith; heirs can challenge if undervalued. For foreign-owned assets, repatriation rules apply (see below).

We assist with sales, including marketing deceased estates (e.g., we currently handle discounted condos/houses from probates). Average sale time: 1–3 months.

5. Repatriation of Sale of Assets

Repatriating proceeds (e.g., to heirs abroad) is straightforward post-distribution but requires compliance with Bank of Thailand (BOT) and anti-money laundering rules. No restrictions on outbound transfers for legitimate inheritance, but proof is needed to avoid scrutiny.

- Process:

- Executor distributes net proceeds (after debts/taxes) via bank transfer (SWIFT for international).

- Provide supporting docs: Probate order, sale contracts, tax clearances, heir affidavits (translated/legalized).

- Bank verifies (e.g., HSBC/Citibank handle large transfers; fees 0.25–1% + THB 500–2,000).

- BOT reporting: For transfers >USD 50,000, submit Form FET (Foreign Exchange Transaction) with proof of source (inheritance/sale).

- Embassy involvement: If heirs are abroad, embassy may act as intermediary (e.g., for small amounts <USD 5,000).

- Timeframe: 1–4 weeks post-distribution.

- Costs: Bank fees (0.1–0.5% of amount); currency conversion (1–2% spread); potential home-country taxes (e.g., on gains).

- Challenges: Digital assets (e.g., crypto) require special handling (exchange to fiat first); ensure POA for executor if abroad. We coordinate with foreign banks/embassies to facilitate seamless transfers.

In our practice, we have successfully repatriated millions in proceeds for international heirs, often using POAs to avoid travel.

If this relates to a specific estate (e.g., a family member), please provide more details for tailored advice. We can act as executor or under POA to minimize your involvement. Schedule a free initial consultation via our website (thai888.com) or email.

Best regards,

Kelvin

Manager, Thai888 Law Company Pattaya Ltd.

Address: 478/10 View Talay Condominium 5D, Thappraya Road, Nongprue, Banglamung, Chonburi 20150, Thailand

Phone: +66 80 102 8978 | Email: [email protected]

Website: thai888.com